In today’s fast-paced, ever-transforming world of payroll, having the right tools at your disposal can be a critical factor that determines your adaptability and continued success as a payroll service business. And now, with the release of Humanised Payroll Version 2.0, key payroll players will have a choice to make in differentiating their services further.

We’re proud to introduce the newest and most advanced version of Humanised Payroll yet, packed with numerous innovative features that will transform how you process payroll, offering an experience worth sharing with others in the business. It may be time to reconsider the hassle of outdated software and inefficient manual processes and instead start enjoying a new level of efficiency, as we’ve outlined below.

1. Improved Automation

The Humanised Payroll team is constantly looking for ways of automating repetitive and labour-intensive aspects of payroll processing, so accountancy firms can provide better and more efficient payroll services to their clients. It was evident to us that most payroll accountants find it challenging to process payrolls with multiple complexities like no pay deductions, overtime payments, or foreign currency pegged payrolls. Below, we go into what we have done to reduce your workload in processing such payrolls!

- Foreign currency

You don’t have to calculate pegged payrolls manually anymore. Instead, you can now define your base exchange rate, currency type and preferred method of handling pegged payrolls once in company settings, and when you create your next month’s pay run, simply add the exchange rate for the current month’s pay run.

Depending on whether you choose to add the variance as an allowance or add it to the basic salary, Humanised will do it for you.

- No pay deductions and Overtime payments

You can now upload the number of no-pay or overtime days and hours when creating a new pay run manually or by using the bulk upload option and generate auto-calculated No Pay Deductions and Overtime Payments in your draft pay run. In addition, you can maintain up to 5 different overtime types at different rates to suit your client’s needs.

2. Improved reporting

We are also excited to let you know that Humanised Payroll now generates 3 of the most sought-after reports in local payroll and taxes.

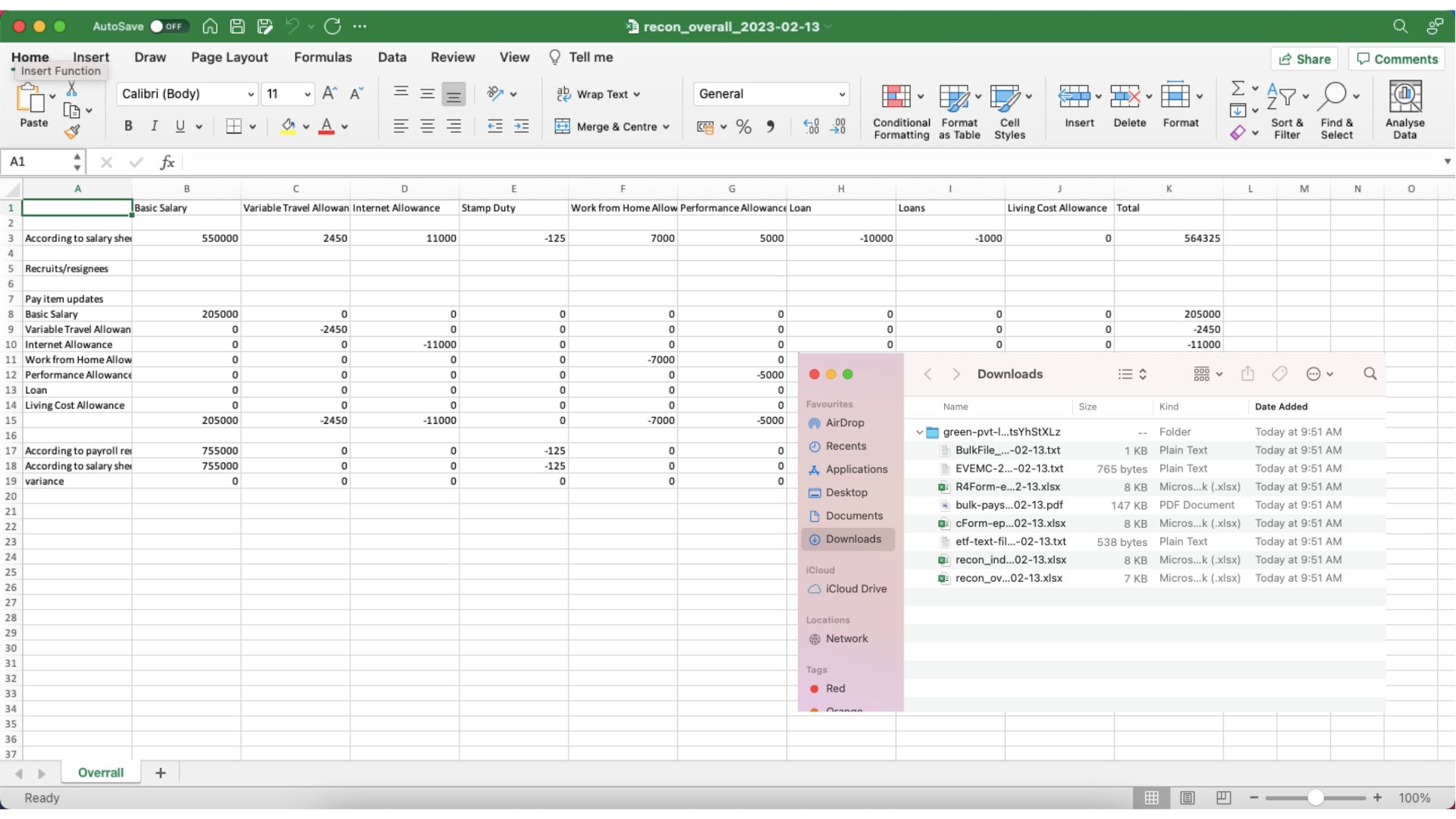

- Payroll reconciliation reports (Overall and Individual)

All new payroll reconciliation reports will help you compare your current pay run with your last to verify and review changes to the current pay run. You can download the summarised overall report and a more detailed one on an individual level.

- T10 (Certificate of Income Tax Deductions)

T10 is the form employers must issue to their employees detailing the amounts remitted to the Inland Revenue Department on their behalf on or before 30th April of the proceeding financial year. You can now download autogenerated and completed T10 forms for each and every employee without having to do any manual work at all.

- Annual Statement of Employer

The Annual Statement of Employer is submitted to IRD on or before 30th April. It details the total tax amount payable for the employees under the employer for the financial year that ended. However, you don’t have to refer to any of your past pay runs manually anymore. Annual statement of the employer will be generated automatically at the click of a button, saving you a lot of time that’s best spent elsewhere.

3. Improved Income Tax coverage

Humanised Payroll users have been benefiting from automated APIT calculations on monthly regular earnings (Table 1), cumulative annual earnings (Table 5), and lump sum earnings (Table 2) since our first release. In addition, we are excited to introduce you to automated tax-on-tax (Table 6) calculations and Non-cash benefits calculations.

- Tax on tax

Tax on tax is calculated when the employer remits or reimburses an employee’s tax liability. We now help you handle tax-on-tax scenarios and calculate the total tax liability for the employer.

- Non-cash benefits

Non-cash benefits also need to be taxed under employee earnings. Since regulations surrounding the tax liability for non-cash benefits were revised recently, employers must adhere to them more vigorously. With Humanised Payroll 2.0, you can add non-cash pay items to your payroll and deduct taxes from them.

4. Gratuity

Gratuity can be a significant concern in keeping track of all financial liabilities of a company when it comes to employee compensation or payroll. Therefore, our newest version introduces a basic gratuity liability tracker. Using this feature, you can track your financial liability in terms of gratuity each month.

Now, you can sense why we were excited to make this announcement! And we’d be happy to take you through the nitty-gritty of the newest version to help you understand how you can optimize your payroll process with its latest capabilities. So please reach out to us if you’re keen to learn more.

As always, the Humanised Payroll team strives to improve our payroll service offering in alignment with the dynamic payroll ecosystem locally and global payroll automation benchmarks. We look forward to bringing you even more valuable additions in the coming months so you can further optimize and grow your payroll business.